Evaluating the HOA on a Condominium for an FHA Reverse Mortgage

Evaluating the HOA on a Condominium for an FHA Reverse Mortgage

This guide is for real-estate agents, financial advisors, and savvy homeowners evaluating the HOA on a condominium for an FHA reverse mortgage. Use it to avoid expensive surprises and loan denial.

Quick Wins When Evaluating the HOA on a Condominium for an FHA Reverse Mortgage

- Verify ≥ 50 % owner-occupancy and < 15 % delinquencies.

- Scan the HUD-9991 form before paying for a condo cert.

- Check the master policy for 100 % replacement cost and deductibles under $10 k.

- Email the 10 questions in Step 6 first—save time and money.

Step 1 – FHA Spot-Approval Basics for Evaluating the HOA on a Condominium

- Project complete—no active construction.

- ≥ 5 units, ≥ 50 % owner-occupied.

- ≤ 10 % FHA concentration (max 2 units if < 10 total).

- No unresolved litigation or financial distress.

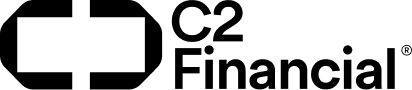

Step 2 – HOA Financial Health When Evaluating the HOA on a Condo for an FHA Reverse Mortgage

- ≥ 10 % of budget to reserves or a reserve study < 24 months old.

- Delinquencies below 15 %.

- Operating and reserve funds in separate accounts.

Step 3 – Insurance Traps When Evaluating the HOA on a Condominium for an FHA Reverse Mortgage

- 100 % replacement-cost hazard coverage.

- ≥ $1 M liability.

- Fidelity bond if 20+ units or >$50 k in funds.

- Flood insurance if required by FEMA.

Watch out: massive deductibles on roofs or “walls-in” exclusions.

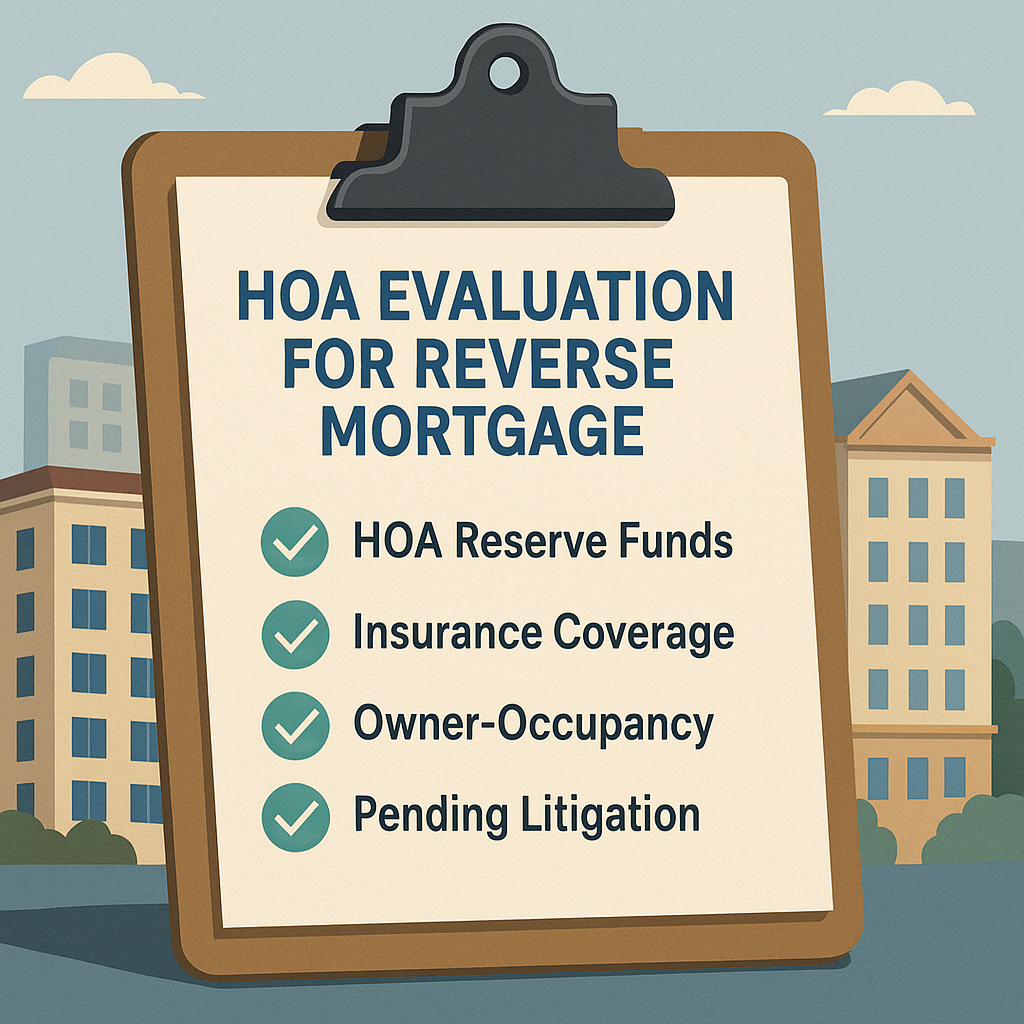

Step 4 – Deal-Killers That Stop an FHA Reverse Mortgage on a Condo

- Reserves underfunded or no recent study.

- Delinquencies > 15 %.

- Pending structural litigation.

- Commercial space > 35 %.

Step 5 – General HOA Health Tips for an FHA Reverse Mortgage

- Reserve study funded ≥ 70 %.

- Budgets & meeting minutes readily available.

- Common areas kept in good repair.

Step 6 – Pre-Screen Email While Evaluating the HOA on a Condominium

Copy/paste and send before paying for a condo cert:

Subject: A couple of questions before I request a questionnaire

To whom it may concern,Questionnaires have become very expensive. Could you please help me determine the following before I spend a lot of $ on a questionnaire.

- Is the current owner-occupancy percentage greater than 50%?

- Are more than 15% of units 60+ days delinquent?

- Does any owner/entity own >10 % of units?

- Could you send me the master insurance policy?

- Does the HOA perform any short-term rental property management activities?

- Is there any structural deferred maintenace that would be identified in a questionnaire?

- Are there any current special assessments?

- Is there any pending litigation?

- Is the HOA developer controlled? Are there any portions of the project still under construction?

- Do you know if there is commercial space and if so, is it more than 35% of the total square footage?

Frequently Asked Questions

What makes a condo ineligible for an FHA loan or reverse mortgage?

High delinquencies, low reserves, litigation, or missing insurance.

Can you get a reverse mortgage on a condominium?

Yes—if the condo passes FHA Single-Unit Approval.

What should I ask the HOA first?

Occupancy, delinquencies, reserves, insurance, assessments, litigation.

About the Author

Christopher Gibson is a mortgage loan officer licensed in CO, FL, MI, TX, GA, and WA, and a former real-estate agent. He specializes in FHA reverse mortgages and condo lending strategies.

Next step: Download the HOA checklist & email template to screen any condo before applying.

Need advice? Email Chris directly.